Key Takeaways

- The insurance industry is competitive, and insurance agents face many challenges when working with clients, managing them and closing more deals.

- CRM systems can help businesses to improve ROI by automating tasks, tracking leads, enhancing customer relationships, managing multiple agencies, and forecasting sales.

- When choosing a CRM system for an insurance company, it is important to consider factors such as the ability to capture prospects seamlessly, automated lead assignment, deal tracking through the sales pipeline stages etc.

Amidst the ferociously competitive market in the insurance sector, you need a way to stay on top of your game. When you’re on the path of growth, you need to capture and nurture every prospect.

And the key to accomplishing that is effective communication, which you can achieve only when you have access to the best CRM for insurance agents which can simplify the way of managing your work process.

Insurance agents and brokers deal with multiple tasks and clients every day. From calling prospects to closing deals and scheduling appointments, they’ve got a lot on the platter.

Therefore, without a streamlined process of managing tasks, an agent might miss out on essential tasks. To prevent such errors, you need insurance CRM software that is intuitive and adds value to your company.

First, let’s look at what insurance CRM is and the challenges insurance agents face to understand CRM’s needs in business.

- What is insurance CRM

- Challenges an insurance agent faces regularly

- How can a CRM system help businesses to improve ROI?

- Benefits of CRM for the insurance sector

- Choose the right insurance CRM that meets all the needs

- 6 Best insurance CRM software in 2023

- How Salesmate CRM can enhance the workflow of insurance agents?

- Some additional features of Salesmate that can help boost your sales

- Frequently Asked Questions

What is insurance CRM?

Insurance CRM is an essential tool that helps you build lasting relationships and increase customer retention. It automates all those menial tasks for you like lead capturing, workflow management, activity tracking, you name it, and it’ll take care of it.

Insurance CRM software is designed specifically for companies and insurance agents. It facilitates them in working effectively to convert more prospects into customers. In these times, an automated data process is pivotal to meeting a multitude of requests and inquiries. So, this is where you need a CRM to stand out from the masses.

Challenges an insurance agent faces regularly

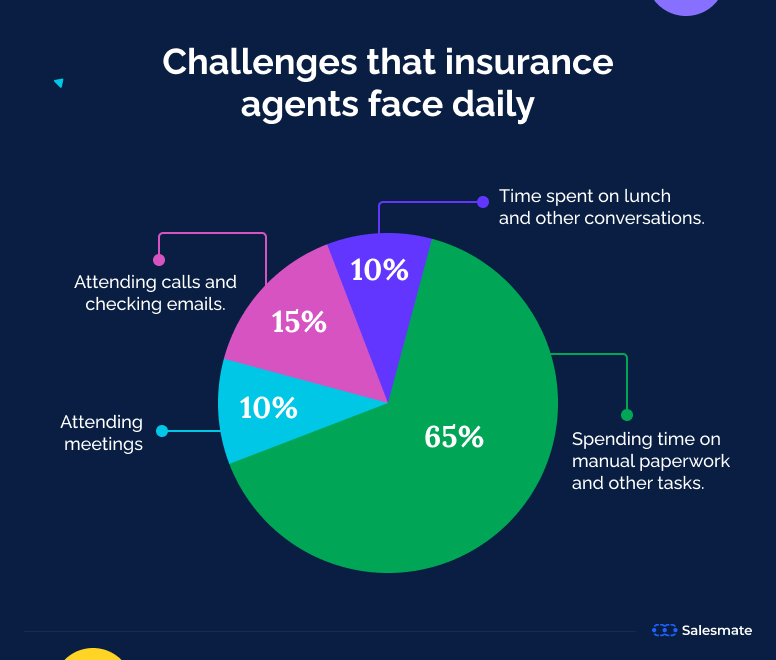

As we mentioned earlier, it’s a competitive market, and insurance agents tackle a myriad of issues when they’re working with clients.

On a daily basis, an insurance agent faces high competition, fragmented data issues, inefficient workflows, extremely tough lead generation, and many more problems.

So, here we have shed light on all the challenges that agents and brokers from the insurance sector face.

1. There’s close competition

Has it ever happened that you got an inquiry from a client just a day back, and they’ve already moved on to the competitor?

Well, for you, it must be just a day, but this generation Z is quicker than you think; a slight delay in revert and consider them gone!

The insurance sector especially faces cut-throat competition when it comes to gaining more clients. And it’s not the fault of an insurance agent as well; they’re already going the extra mile when it comes to completing tasks.

This is where automation comes in; let the software handle manual tasks so the insurance agent can go ahead and work to his full potential.

2. Your sales process is fragmented

Yes, spreadsheets and excels are good sources of storing data. However, you must’ve experienced fragmented data and information, which affected the client relationships as well.

When you’ve got a lot of information on your plate and don’t have a streamlined way of processing it, errors are bound to happen. While this manual practice is followed by many, it does more harm than good in the long run business.

3. Inefficient workflow is hampering the revenue

The major drawback of every insurance agency is inefficiency in the workflow. Manual handling of sequential tasks can take up too much of your time, resulting in low productivity and scattered workflow.

From processing policies, renewals, and taking follow-ups, all while keeping the communication with clients intact, the workflow becomes relatively inefficient and leads to a decline in revenue.

One can’t expect repeat business when the workflow itself isn’t up to the mark. Companies need to level up and combat these challenges; as such, decreased productivity will lead them nowhere.

4. Lead generation is getting difficult

A client is always inclined towards a company that provides a solution to all their problems. When a customer has to navigate through various stages, their interest in purchasing your policies might ebb.

These days, people prefer to opt for products that call for less hassle and derive more value. So, to generate leads and eventually convert them into customers, you need a quick implementation strategy.

5. You’re not able to retain your customers

From the challenges mentioned above, it’s apparent that there’s room for improvement in your business. Not being able to retain customers is certainly discouraging; however, everything is up to you now.

You can wade through the obstacles only when you have a supportive CRM by your side. Otherwise, this pattern will keep on hindering the overall growth of your company.

Once you’ve realized what’s holding you back, all you need to do is take a leap and achieve what seemed impossible!

Implement a smart CRM in your insurance agency and just sit back to witness how it helps you prosper!

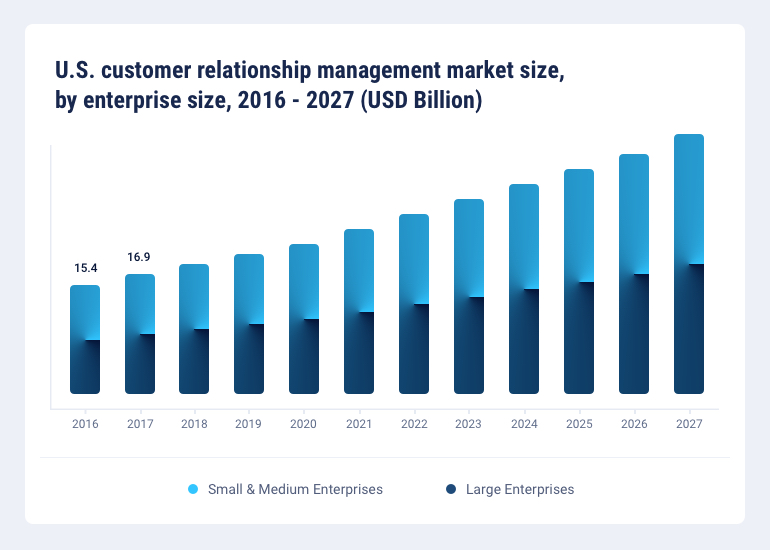

To overcome the challenges, the majority of businesses are leaning towards automated CRM systems. Both large and small enterprises have approached the streamlined process of CRM over the conventional process of manually working on projects.

Below you will see how the trend of CRM usage in both small and large enterprises has witnessed rapid growth.

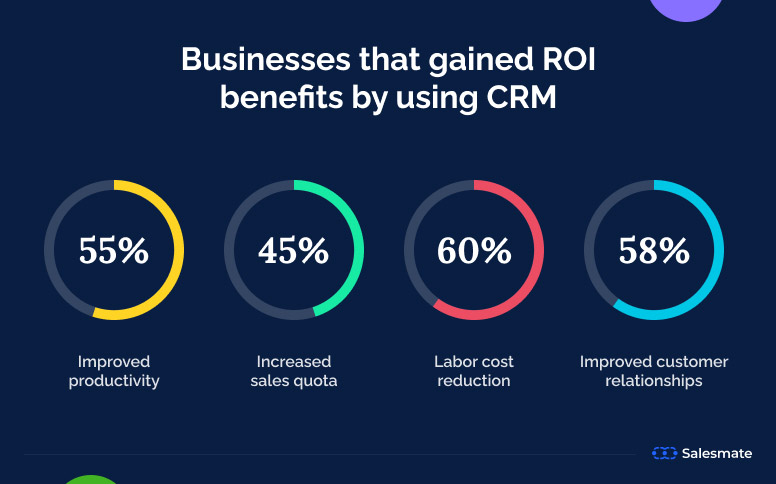

Studies have shown that implementing a CRM system in any company has proven highly beneficial for its revenue and has improved productivity. Check out how CRM software can increase ROI.

How can a CRM system help businesses to improve ROI?

If you thought a CRM just helps automate the workflow, you might want to check out the statistics. When your work process is streamlined, it will result in better productivity and, therefore, improved ROI.

As per the statistics, the right CRM can improve productivity by 55%, increase sales quota by 45%, reduce labor cost by 60%, and improve customer relationships by 58%.

These statistics are factual indicators of how a CRM system can significantly impact a business and its revenue.

So, what are you waiting for? Get a CRM that adds value to your work and lets you grow without any limit. Although, ensure you pick the CRM that fits all the needs of your team members and business.

Benefits of CRM for the insurance sector

CRM has numerous benefits for the insurance sector and can help companies in improving their business processes with automation.

You can find new leads, capture them from multiple channels and create a personalized outreach strategy to convert them into customers.

Moreover, CRM has also proven to be highly beneficial for streamlining the processes of internal workforce by automating manual day-to-day tasks.

Here are the main benefits of the insurance agency CRM software –

1. Improved data management

Insurance agents handle a lot of paperwork and information for each client, as the entire insurance process is rather extensive. Therefore, there is a possibility of a loss of data and errors when it’s been managed manually.

In this scenario, insurance agencies can adopt CRM software so all of their insurance agents can work collaboratively and improve their overall performance. You can collect all the client data within the CRM so you never have to worry about it.

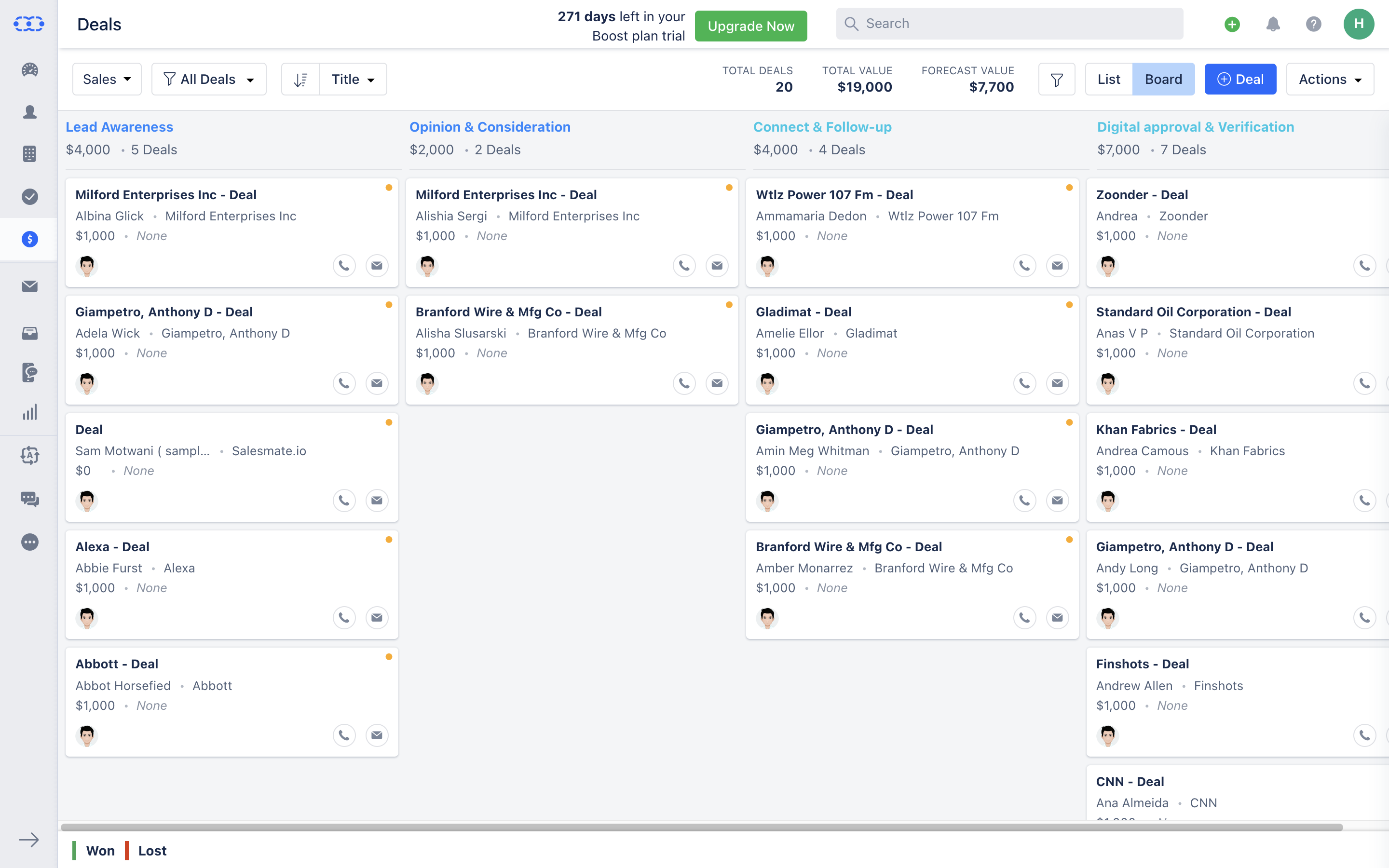

2. Tracking leads

Lead management can get tricky when you have multiple leads in the pipeline. If you want to generate more sales, you need to manage your leads efficiently and stay in constant touch with them. With lead management, tracking your leads becomes easy.

So, you’d know whom you have to follow up with, which lead requires more nurturing and which lead can be closed immediately.

3. Enhanced customer relationship

An insurance CRM enables you to stay in constant touch with your past and present clients using text and email sequences. You can leverage this feature to share regular updates on any policy change, attract more prospects and upsell and cross-sell your policies.

Take your customer relationships to the next level!

All communication channels inside Salesmate.

Try FREE for 15 days4. Manage multiple agencies

CRM is not only for small and mid-level businesses; it also allows large-scale insurance companies to manage multiple agencies. When you have agencies in different locations, you can utilize insurance CRM to stay on track with every change and get timely updates.

5. Forecast your sales

For creating better sales and marketing strategies, you need to be aware of the current situation of your business.

With insightful sales reports and analytics, you can compare past sales figures to spot trends. Moreover, you can also forecast sales by considering the main factors affecting your sales.

Choose the right insurance CRM that meets all the needs

Investing in a CRM is essential for every business, but investing in a good CRM is what everyone must practice.

Take all the requirements of your team members into account and check whether the CRM you’ve got your eyes on is capable of fulfilling them or not.

For every insurance agent, organizing data and handling clients is a priority, so get an Insurance CRM that excels in these aspects.

To make your selection process simpler, we’ve come up with these points. Ensure you refer to them whenever you’re selecting a CRM for your life or health insurance agents.

1. Capture prospects seamlessly

Capture and nurture your leads even when you’re traveling; there’s no limit to prospecting with a good CRM. It helps you reach interested prospects that you can later reach out to and convert into customers.

“CRM can boost conversion rates by 300%.”

(Source – Entrepreneur)

Attract, convert, close, and delight every client that comes your way. An intuitive CRM will help you efficiently close more business.

2. Automated lead allocation

Now, you can easily allot leads to sales agents and brokers for higher productivity. CRM for insurance offers automated lead management and allocation, so you don’t miss out on any lead.

It stores all the crucial data and allows streamlined allocation so your agents and brokers can get started and reach out to potential leads. This automated practice saves you time and helps manage all the leads from just one page.

3. Affordable and scalable

A good CRM will give you space to grow without burning a hole in your pocket.

Choose a CRM for insurance agents that is affordable and scalable with your growth. Go through all the add-ons that the CRM is offering and check whether they’ll be beneficial for you or not.

Your Insurance CRM at just $12/user/month!

A CRM that just works for your insurance business.

Try FREE for 15 days4. Customizable features

Insurance companies offer different policies and insurances, so it’s imperative to check whether the CRM you’re opting for is customizable or not.

You must be able to customize the features and interface as per your company’s requirements to achieve optimal productivity.

5. Quick and effective support (Team Inbox)

Work within a collaborative space with your team members. Team inbox lets you solve customers’ queries efficiently. Provide a high-end experience to your clients by managing email conversations in a shared environment.

6. Keep track of all activities

Have you been wondering whether your team members are indeed working or just acting like it? Well, track their every activity to ensure that the work is getting done in time. Track, plan and organize your sales activities using this tracking feature.

7. Sell on the go with mobile CRM

Don’t limit your work to a cubicle; expand your horizons and work without limits with Mobile CRM. Manage and sell on the go by accessing CRM on your mobile.

Whether you’re traveling or on a field trip, never miss out on any details. Explore every opportunity and boost your sales.

8. Upsell and cross-sell opportunities

Don’t miss out on any opportunity! Upsell and cross-sell for a better experience. Keep them in the loop for all the upgrades and upsell/cross-sell opportunities that they can avail to boost their growth.

9. Manage and update policies

Insurance policies tend to change now and then; update them using CRM from anywhere and anytime! Notify your customer about the change in policies so they can work accordingly.

10. Develop client trust

The services will speak for themselves when you’re using a smart CRM. With an automated CRM, you’re not only gaining more clients, you’re also developing their trust.

According to a survey conducted by Capterra, 47% of CRM users said that using a CRM system had a positive impact on customer retention.

When a customer is happy with the services, they won’t think of switching to another insurance agency. So, always give priority to your clients.

Want to become a top Insurance Agent?

See how Salesmate can help acheive your goals.

Start My Trial Now6 Best insurance CRM software in 2023

Check out the top insurance CRM software available in the market.

1. Salesmate

Salesmate is a versatile CRM that allows you to automate your entire customer journey.

This CRM for insurance agents helps you to manage your client data, have a 360-degree view of all your deals, manage your workflows, and automate marketing, sales, and CX processes.

Salesmate is one of a kind CRM that offers various features and allows you to customize it as per your requirement, making it the most versatile software.

Key features

- Sales and marketing automation

- Contact management

- Built-in calling and power dialer

- Email marketing

- Workflow management

- Meeting scheduler

- Live chat

- And much more!

Price – The Starter plan is $12 per user per month.

2. Radiusbob

Radiusbob is a platform that offers sales and marketing automation so your insurance agents can focus on important tasks. Radiusbob CRM is developed especially for insurance agencies, hence making it a simple and easy-to-access CRM.

You can manage your leads, streamline your sales and marketing process, and with integrated VoIP, make calls directly from the CRM.

Key features

- Lead management

- Built-in telephony solution

- Sales automation

- Marketing automation

- Autoresponders

Price – The plan starts at $34 per month.

3. Insureio

Insureio enables insurance agencies to grow their book of business by leveraging the power of sales and marketing automation.

Insurance agencies can quote over 40 leading carriers for term life, disability, LTC, permanent life, and annuity.

Key features

- Lead management and tracking

- Application fulfillment

- Pre-built email marketing templates

- 30+ carriers

- Quoting widgets

Price – Basic plan starts at $25 per month.

4. Insly

Insly is a cloud-based CRM, allowing insurance agents to add clients without any hassle, making it an instant broker portal.

You can easily manage all your products, clients, and other tasks with Insly. Insurance agents can add and manage insurance policies by viewing active offers, claims, installment schedules, etc.

- Client management

- Unified data management

- Tracking claims

- Insurance policy management

- Getting estimates and quotes

Price – The plan is priced at $59 per user per month.

5. Oracle

Oracle is a cloud-based software built specifically for the insurance industry.

With Oracle, you can create insurance journeys for enhanced customer experience, process billing and policies, and automate your processes. Do all this from just a single platform!

Key features

- Account and contact management

- Pipeline management CRM

- Marketing automation

- Customer support portal

- Reporting and analytics

Price – Pricing not provided.

6. AgencyBloc

AgencyBloc is an easy-to-use CRM software for insurance agencies. You can easily manage your clients and prospects from one platform.

This CRM for insurance agents helps you in creating a simplified process for your workforce by offering powerful features. It’s an industry-specific CRM that helps you have improved customer relationships and build lasting connections.

Key features

- Contact management

- Task assignment and activity tracking

- Email marketing

- Document management

- Actionable reports

Price – The plan starts at $70 per month.

How Salesmate CRM can enhance the workflow of insurance agents?

Salesmate is your one-stop solution for any CRM need. It offers feature-rich CRM software for your life and health insurance agents and brokers that is tailor-made for agencies and brokers to increase their sales and grow revenue.

With Salesmate CRM, automate all the daily tasks so you can focus on closing high-quality deals. For overall productivity and enhanced growth, CRM is a must.

The below feature list will help you determine how Salesmate can contribute to your team’s productivity. Salesmate works as an insurance CRM software and helps you grow your business.

1. Automate your sales and marketing processes

Salesmate’s automation journeys allow you to create marketing automations based on specified conditions and are triggered by your user’s actions. You can easily set up automation journeys with drag and drop.

Moreover, you can engage with your prospects at the right time by personalizing your campaigns with automation. Right from prospecting to eventually closing the deal, you can automate every aspect of your customer’s journey.

2. Collect visitor information

With Salesmate’s web forms, you can collect the information of your website visitors without any hassle. Whether it’s taking a survey or asking for contact details, you can utilize web forms to gather information and use it for prospecting.

You can customize the web form according to your brand requirement and share it on various channels. You can also embed the code on your website page.

3. Schedule meetings with ease

Working in the insurance sector can be quite hectic, with so many tasks and meetings, you need to keep your calendar updated and clear. This helps you avoid overlapping meetings.

With Salesmate’s meeting scheduler, you can manage all your meetings and tasks right form the CRM. You can also share the link with your prospects and clients so they can book the available slot.

4. Provides a 360-degree view of clients

A versatile CRM provides insight into every aspect of your client information. You can capture leads, track their conversations and activities, store crucial data, and enrich them using a contact management feature. A reliable data repository lets you import data from anywhere so you can utilize the same for converting more prospects into customers.

Keep in touch with all your clients in real-time to leave them delighted. Prioritize and nurture relations for better sales and overall growth.

5. Easy onboarding

Put your clients at ease by offering a seamless, onboarding experience. Engage them with personalized texts and emails, timely reminders, and track their activities.

Tailormade notifications and messages are sure to impress your client and build lasting, strong relations. Moreover, you can also generate follow-up sequences until your interested prospect turns into a client.

6. Documents processing

The vital aspect of every insurance agency is managing and processing the documents. An insurance agent receives various documents from different clients and needs to process them at the end of the day. CRM for insurance can meticulously process all the documents and update them accordingly.

7. Acquire more leads

When you’re already on top of your game with the help of CRM, you’ll automatically attract and nurture leads. Quick communication, timely follow-ups, and a helpful demeanor can go a long way in building lasting relationships with clients.

8. Powerful integrations

You don’t have to switch back and forth between multiple apps anymore. CRM software allows you to integrate with numerous platforms such as Google Apps, Quickbooks, Zapier, RingCentral, and much more. Integrate these apps into your CRM system, and you’ve got everything in just one place.

9. Easily accessible dashboard

Insurance CRM is here to make your work life easier, not the other way around. Therefore, an easy-to-access dashboard won’t leave you confused. Navigate through your CRM system without any hassle and boost your productivity!

Some additional features of Salesmate that can help boost your sales

- Bulk actions – Bulk actions let you update, merge, and manage your data in no time. You can also send bulk promotional emails to your prospects.

- Detailed sales reports – Tailor-made sales reports give you better insights into the sales trends and help you strategize your next move.

- Personalized templates – Make your clients feel valued by using personalized templates in your emails.

- Product management – Add new products and customize the descriptions as per the clients’ requirements.

- Built-in calling – A web-based service that looks after all your calls and texts with built-in calling features. Use UK, Australia or US virtual phone number to reach clients from different locations.

- Power dialer – Automated power dialer helps you switch from one call to another without any effort. Schedule your calls, and it’ll handle the rest.

- Goal tracking – Become ambitious and set goals to exceed your expectations. Track and manage your goals to stay more productive.

- Flexible – Salesmate is designed to fit the different needs of every client. This flexible system can be used for any type of sales process.

- Email tracking – Win more deals by keeping track of opened emails and follow-up in real-time.

A value-driven CRM that works for you!

Explore Salesmate completely free for 15 days.

Experience SalesmateFrequently Asked Questions

Why is CRM software important for insurance agents and brokers?

CRM software helps insurance agents and brokers in sales by providing them with an organized view of customer data. Insurance agents can easily track information like contact information, policy details, billing history, and other pertinent customer data. This enables them to better serve their customers, as well as quickly access the necessary information for making informed decisions about sales opportunities.

Using CRM software for insurance agents, you can also easily contact prospects and send automated follow-up emails to remind them of upcoming payment deadlines or policy renewals. Additionally, CRM software provides agents with sales analytics that help them identify potential sales opportunities and target specific customer segments. By leveraging the power of CRM for insurance brokers and agents can better understand their customers and have an easier time closing sales. Ultimately, this helps make them more successful in their sales efforts.

Ultimately, CRM software for insurance agencies is an invaluable asset, as it makes customer management easier and allows them to focus on closing sales. It also enables them to better understand the needs of their customers and capitalize on new opportunities for increasing revenue. By streamlining customer management and leveraging powerful analytics, CRM software helps agents and brokers to improve their sales results.

What are the key features of CRM for your insurance business?

Below are some of the important key features of CRM for an insurance business:

- Lead Management: Agents can use CRM software to identify potential sales opportunities and target specific customer segments. CRM will provide intelligence to help agents better understand their customers and develop strategies for closing sales.

- Policy Management: CRM software can be used to track policy details, billing history, and other pertinent customer data. This helps agents to manage customer information more efficiently and have an easier time accessing the necessary data when making decisions about sales opportunities.

- Automated Communications: Agents can use the CRM software to send automated emails, text and even make automated calls to prospects and customers. This helps them remind clients of upcoming payment deadlines or policy renewals, as well as keep up with inquiries in a timely manner.

- Analytics & Reporting: CRM software can generate reports that provide agents with valuable insight into the performance of their sales team, as well as trends in customer data. This helps agents to make informed decisions about their business and identify potential areas for improvement.

Some of the important CRM reports for insurance agents and brokers can be:

a. Conversion Report: This report provides insight into the success rates of sales opportunities. It helps agents to understand what tactics are working and which ones need improvement in order to increase their closing rate.

b. Customer Lifecycle Reports: These reports provide data on how long customers have been with the agency, their average policy renewal period, and more. This data helps agents to better understand their customer base and develop strategies for retaining them.

c. Activity Report: This report provides information about the activities that agents have completed with their customers, including follow-up calls, emails, etc. It also helps agents identify areas in which they can be more efficient in managing customer relationships.

d. Sales performance report: This report provides agents with data on the performance of their sales team. It helps agents to understand where their team is excelling and which areas could use improvement in order to increase revenue.

- Automated Follow-Up: Agents can use the CRM software to set up automated follow-ups, and reminders using email and text sequences features. This helps them follow up with prospects and customers at regular intervals and engage better with them to close more deals.

- Customer Support: Some of the CRM features like Live chat, and Shared Inbox helps the customer support team to deliver exceptional customer service by responding quickly to customer and prospect queries. It allows the team to collaborate without any hassle resulting in better and quicker responses.

Overall, CRM for insurance agents and brokers to manage their business more effectively by streamlining customer management tasks. It also provides clear insights into sales performance and opportunities for increasing revenue. By leveraging the power of CRM software, insurance agents can better understand their customers and have an easier time closing sales. Ultimately, this helps make them more successful and profitable.

Why Salesmate is the best CRM for insurance companies?

Salesmate is the perfect CRM for your insurance companies because it will help you with lead capturing & distribution, deal management, pipeline management, and much more.

Our insurance CRM is not just a CRM, but it’s a complete customer journey solution where all three teams can work together in harmony – sales, marketing, and customer service.

Salesmate is a superior solution with industry-best automation capabilities, so you never have to invest your time in manual tasks, ever!

Can you integrate Salesmate with other tools?

Absolutely. Salesmate has native and Zapier integrations with industry-leading tools. Check out our Integrations to know more.

Conclusion

Every insurance agent needs a CRM that is intuitive and flexible. Salesmate CRM for insurance is something that every agency needs to stay on top of their game. Whether it’s automating workflows or managing clients, it takes care of every single thing.

Having unified solutions for all your problems can prove highly beneficial. Having one CRM system that executes and performs all tasks is a boon for every insurance agent.

Salesmate CRM is the next-gen automated platform that is feature-rich and centered around building valuable customer relationships. Try Salesmate CRM once, and you won’t have to look anywhere else!

You may also enjoy these

50+ best marketing and sales tools to look in 2023

Businesses, be it small or big, wish to grow. If they’ve achieved a 10% growth in the current year, they would...

33 Min read15 Clever ways to increase manufacturing sales faster in 2023!

Searching for ways to amplify sales in...

11 Min read21 AI sales tools to boost sales in 2023 [Reviewed & tested]

AI has achieved great leaps forward in making marketing and sales operations easier and...

19 Min readInbound sales guide: Why it should be your top priority in 2023?

In today's digital age, the business landscape has completely changed. And it has also affected the way we connect...

25 Min readANUM sales qualification: All you need to know!

According to a study, 22% of sales reps reported sales qualification as the most challenging part of their sales...

10 Min readMake sales sexy again 😉

- Save at least 50% on subscriptions and integrations.

- Save 30% more time for your sales team.

- Choose a CRM trusted by 5000+ businesses.

Dhara Thakkar

Dhara Thakkar is a seasoned marketer at Salesmate. She thrives on trying new organic strategies to improve traffic & conversions, and has in-depth knowledge on how search works. When she's not working, you will find her travelling or binge watching F.R.I.E.N.D.S